Adani Ports Share Price Target: Adani Ports and Special Economic Zone Ltd (APSEZ), a flagship company of the Adani Group, is India’s largest private port operator. With a significant presence in India’s logistics and infrastructure sector, Adani Ports has consistently delivered growth and performance.

In this article, we’ll explore the future prospects of Adani Ports, its share price target from 2025 to 2030, and the reasons to consider it as a long-term investment.

History of Adani Ports

Adani Ports was established in 1998 as a part of the Adani Group, a multinational conglomerate led by Gautam Adani. Over the years, Adani Ports has expanded significantly, acquiring several ports and terminals across India, making it a dominant player in India’s port sector.

With an extensive portfolio of port facilities and related infrastructure, Adani Ports has played a key role in India’s international trade.

Founder and Their Business Role

Gautam Adani, the founder of the Adani Group, is one of India’s leading industrialists. With a focus on infrastructure development, his vision has shaped the growth trajectory of Adani Ports. Under his leadership, Adani Ports has transformed into a leading logistics company with operations spanning across ports, logistics parks, and special economic zones.

The company’s diversification into areas like warehousing and logistics has positioned it as a critical player in the Indian economy.

Adani Ports Share Price Target (2025-2030)

Here’s a year-wise breakdown of the expected share price targets for Adani Ports from 2025 to 2030:

| Year | Expected Share Price Target (INR) |

|---|---|

| 2025 | ₹1,080 – ₹1,400 |

| 2026 | ₹1,500 – ₹1,800 |

| 2027 | ₹2,000 – ₹2,300 |

| 2028 | ₹2,500 – ₹2,800 |

| 2029 | ₹3,000 – ₹3,300 |

| 2030 | ₹3,500 – ₹4,000 |

These targets are based on the company’s strong growth trajectory, expanding infrastructure, and increasing cargo volumes.

Why to Invest in Adani Ports

Adani Ports is an attractive investment for the following reasons:

- Market Leadership: As India’s largest private port operator, Adani Ports has a dominant position in the market, which gives it a competitive advantage.

- Government Support: The government’s infrastructure initiatives like Sagarmala and the National Logistics Policy are expected to boost growth in the port sector.

- Expansion Plans: Adani Ports is actively expanding its capacity with new terminals and ports, which will drive future growth.

- Diversified Business: The company is involved in logistics, warehousing, and special economic zones, providing a diversified revenue base.

- Sustainability: With a focus on environmental, social, and governance (ESG) initiatives, the company is positioning itself as a sustainable business.

Pros and Cons of Investing in Adani Ports 2025-2030

Pros:

- Strong market position in India’s port sector.

- High growth potential with ongoing infrastructure development and port expansions.

- Diversified revenue streams beyond port operations.

- Government-backed initiatives to improve port infrastructure.

Cons:

- Debt levels could pose a risk, depending on the pace of expansion and funding requirements.

- Market volatility: Like other infrastructure companies, Adani Ports can be impacted by economic slowdowns.

- Competition from other private and public sector ports.

Fundamental View

- Revenue Growth: Adani Ports has shown steady growth in revenue, supported by a strong increase in cargo handling and port utilization.

- Profitability: The company maintains a healthy profit margin due to economies of scale in port operations.

- Debt and Financial Health: The company’s debt levels have been manageable, but continued expansion could increase debt in the future.

- Valuation: The stock is generally considered undervalued in comparison to its growth prospects, making it an attractive option for long-term investors.

Technical View for Adani Ports Share Price Target

The stock of Adani Ports has shown a strong uptrend over the past few years, supported by solid fundamentals. The current technical indicators suggest that the stock may continue its bullish trend, but investors should watch for market corrections and potential volatility. Key support and resistance levels should be closely monitored to time entry and exit points.

Shareholding Pattern for 2025

| Shareholder | Percentage of Ownership |

|---|---|

| Promoters | 66% |

| Foreign Institutional Investors (FII) | 15% |

| Domestic Institutional Investors (DII) | 8% |

| Retail Investors | 11% |

This shareholding pattern reflects the strong control of the Adani Group and significant institutional interest in the company.

Top Brokerage Views on Adani port Share price Target 2025

| Brokerage House | Target Price (INR) | Rating |

|---|---|---|

| Kotak Securities | ₹1,500 | Buy |

| HDFC Securities | ₹1,750 | Buy |

| Motilal Oswal | ₹1,400 | Neutral |

| ICICI Direct | ₹1,400 | Hold |

| JM Financial | ₹1,650 | Buy |

These brokerage views suggest a positive outlook for the stock with varying price targets based on different market conditions.

Peer Comparison

Here’s a comparison of Adani Ports with some of its key peers in the Indian port sector:

| Company | Market Cap (INR Cr) | P/E Ratio | Price to Book | Debt-to-Equity Ratio |

|---|---|---|---|---|

| Adani Ports | ₹2,34,029 | 23.13 | 4.09 | 0.88 |

| GMR Airports | ₹77,904.12 | – | – | -16.30 |

| IRB Infra | ₹33,619.11 | 54.58 | 2.41 | 1.36 |

| RITES | ₹12,238.58 | 32.36 | 4.74 | 0.00 |

| K&R RAIL ENGINE | ₹903.73 | 133.36 | 9.97 | 0.05 |

Adani Ports stands out in terms of market capitalization and has a higher P/E ratio, indicating that investors are willing to pay a premium for its growth potential.

Comparison with Nifty 50 (Top 12 Stocks)

Here’s a comparison of Adani Ports with the top Nifty 50 stocks, focusing on key metrics:

| Stock | Market Cap (INR Cr) | P/E Ratio |

|---|---|---|

| Adani Ports | ₹2.34LCr | 23.83 |

| Reliance Industries | ₹17.11LCr | 24.73 |

| Tata Consultancy Services | ₹14.73LCr | 30.22 |

| HDFC Bank | ₹12.92LCr | 18.59 |

| Infosys | ₹7.67LCr | 27.96 |

| ICICI Bank | ₹8.87LCr | 18.25 |

| Larsen & Toubro | ₹4.74LCr | 35.18 |

| Hindustan Unilever | ₹5.88LCr | 54.78 |

| Bajaj Finance | ₹4.95LCr | 32.19 |

| Bharti Airtel | ₹9.72LCr | 78.65 |

| Asian Paints | ₹2.25LCr | 49.36 |

| State Bank of India | ₹6.83LCr | 9.56 |

Adani Ports holds a higher P/E ratio compared to several Nifty 50 stocks, reflecting the market’s optimism about its future growth.

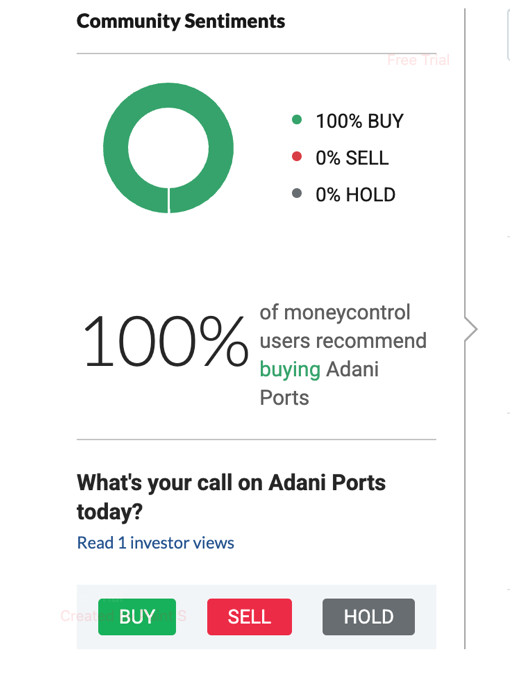

Community Sentiments on Adani Ports Share Price Target 2025

| BUY | 100% |

| SELL | 0 |

| HOLD | 0 |

Conclusion

Adani Ports is a strong contender for long-term investment, with a dominant market position, government support, and impressive growth plans. With a steady track record of financial performance and expansion, the company is well-placed for continued success through 2025-2030. As an investor, it’s important to consider both the positive aspects and the risks before making an investment decision.